Understanding the Walmart Stock Split: A Comprehensive Analysis

One of the largest and most recognizable retail corporations in the world, Walmart Inc. has periodically made significant corporate decisions that reverberate throughout the investment community, such as undergoing a stock split. A stock split is a decision by a company’s board of directors to increase the number of shares that are outstanding by issuing more shares to current shareholders.

The Mechanics of a Stock Split

Before diving into the specifics of Walmart’s stock split decisions, let’s clarify what a stock split entails. Essentially, when a company enacts a stock split, it increases the number of shares held by investors, while proportionally decreasing the price of each share.

For example, in a 2-for-1 stock split, each share an investor owns is doubled, yet the price of each share is halved. This means if you owned 10 shares at $100 each before the split, you would have 20 shares at $50 each after the split. The total value of your shares remains the same immediately before and after the split.

Walmart’s Stock Split History

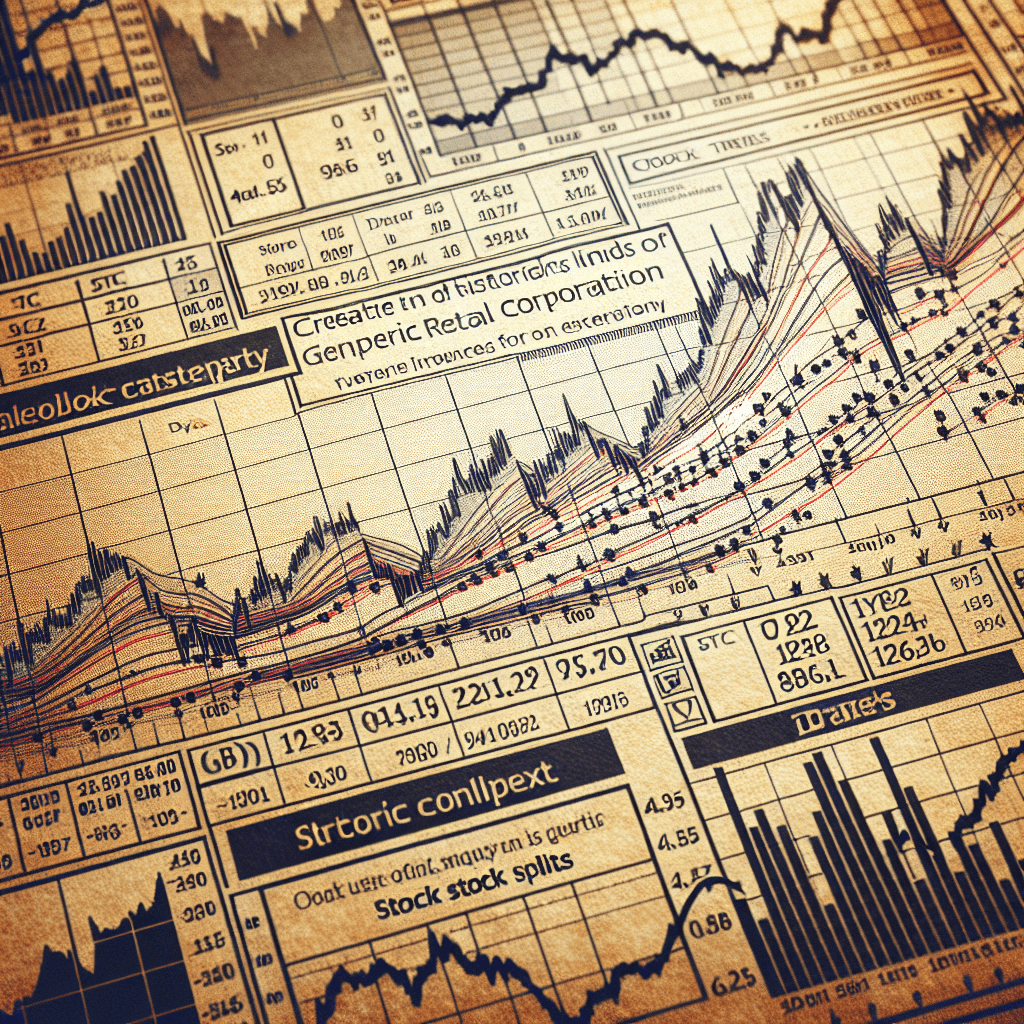

Walmart has performed multiple stock splits since its initial public offering (IPO). Historically speaking, these splits occur when a company’s share price has increased to a level that might be too costly for average investors. By splitting the stock, the share price is lowered, which can make it more appealing for new investors while maintaining equity for existing shareholders.

It’s important to note that when looking at Walmart’s historic performance on the stock market, discerning between past splits and current positions is crucial. Older data might show significantly lower share prices, but adjusted for splits, one would realize the performance trend chronicles notable growth over time.

The Strategic Impact of Stock Splits

The decision for a giant like Walmart to implement a stock split often goes beyond just reducing share prices. It’s typically viewed as an affirming signal concerning the company’s health and future growth potential. These positive psychological perceptions can benefit Walmart in several ways; it may improve market sentiment toward its stocks or indicate robust financial health and consumer confidence.

The aftermath of stock splits can sometimes produce momentum for increasing share prices as well. This may not necessarily stem from direct company value growth but rather from increased liquidity and more accessibility for all ranges of investors.

Market Reception and Investor Sentiments

In the case of any significant corporate manoeuver such as a stock split, market reception tends to range broadly. Some investors will regard a stock split as a non-event since it does not inherently affect the company’s market capitalization or fundamental valuation. However, others view it as an opportunity due to potential psychological impacts on investor behavior, potentially translating to upward price movement.

Walmart in Comparison with Other Companies

Walmart isn’t alone in considering and enacting stock splits. Major tech firms like Apple and Tesla have also executed similar maneuvers in recent years, showcasing their prevalence within varied sectors of the economy. Comparing different companies’ strategies in using stock splits allows observers to understand overarching industry trends as well as specific corporate outlooks.

Notes

Image Description:

An image showing a chart with trending lines, illustrating Walmart’s historical stock prices over an extended period. A series of markers on the chart indicate past dates on which the company announced and completed its various stock splits. The surrounding context would show trading activity with ups and downs reflective of market responses to company developments and economic conditions over time.