### The Comprehensive Overview of the Concept and Applications of Levy

Levies are a critical aspect of fiscal policy and financial systems within economies. They can refer to charges imposed by governments or organizations to fund specific projects or for regulatory purposes. The understanding of levies is essential for individuals, businesses, and policymakers alike as they represent a critical revenue-generating mechanism and can have profound effects on economic behavior and social infrastructure.

What is a Levy?

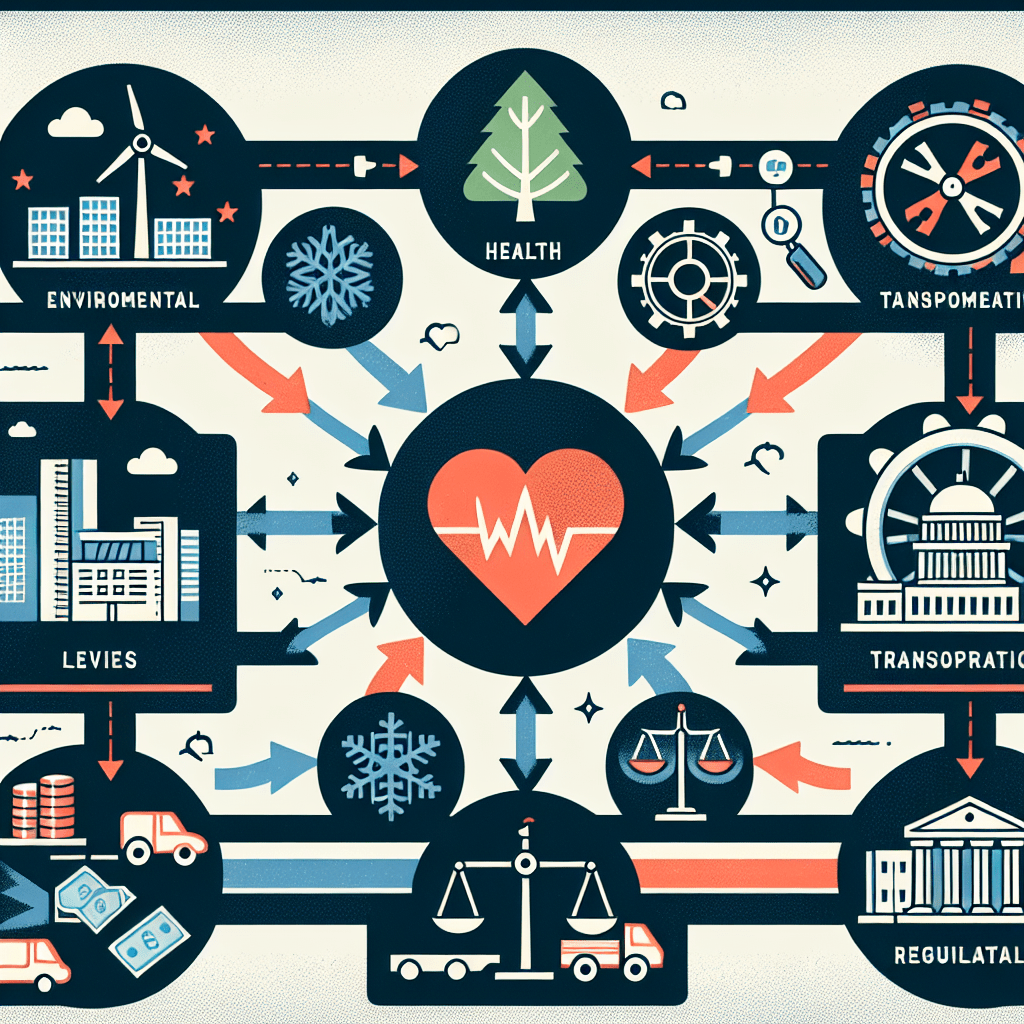

Levies are a form of taxation or charge applied by government or other bodies, often used to fund specific public services or goods. Unlike general taxation, which goes into a central ‘pool,’ the proceeds from a levy are typically designated for a particular purpose. Examples include environmental levies to protect natural resources, health levies to finance public healthcare systems, and transportation levies allocated to infrastructure improvements.

Types of Levies and Their Characterization

Different types of levies serve different functions within economic systems. These can take the form of fixed amounts per transaction, percentages of value, or charges based on certain uses or behaviour.

–

Environmental Levies Environmental levies are aimed at reducing pollution and promoting sustainable practices. They might include charges on plastic bags, carbon emissions, and disposal of hazardous waste.

–

Health Levies Designed to underwrite public healthcare costs, these can be seen in taxes on tobacco, alcohol consumption, or as a part of payroll taxes contributing to national or regional health insurance schemes.

–

Transportation Levies Often applied to fuel sales or vehicle registration to ensure steady funding for the maintenance and construction of roads, bridges, and public transit systems.

–

Regulatory Levies Charges for licensing and regulatory compliance in various fields. This could include industries like telecommunications, broadcasting, financial services, etc. How Levies Impact Economies

How Levies Impact Economies

Levies induce both positive and negative impacts on economies. On one hand, they provide necessary funding without which many essential services and projects could not be sustained. On the other hand, excessive or misdirected levying has the potential to inhibit economic growth or penalize certain sectors.

–

Economic Advantages By aligning funding directly with their usage sectors, levies make cost-benefit clear while promoting accountability.

–

Considerations for Businesses Companies often incorporate the cost of levies into consumer pricing; these added costs need to be balanced with competitive pricing strategies. Global Perspective on Levying Practices

Global Perspective on Levying Practices

The application and structure of levies vary widely around the world due to differing geopolitical landscapes, economic models, and social priorities.

–

In Europe Countries like Denmark and Germany implement heavy environmental levies to incentivise green energy usage and reduce carbon footprints.

–

In Asia Nations such as Singapore impose regulatory levies to maintain high standards within its financial sector while utilizing transport levies efficiently in their transport infrastructure projects. Challenges and Debates Surrounding Levies

Challenges and Debates Surrounding Levies

Taxation through levies can spark contentious debates centred around who should bear the most burden and how efficiency can be maximised without stifling business growth.

–

Impact on Lower Income Populations Often argued that fixed or regressive levy structures disproportionately impact lower-income groups.

–

Implementation and Administration Cost Efficiency Ineffective administration of levies can lead to ballooning overheads which diminish their intended positive effects. Future Trends in Levy Implementation

Future Trends in Levy Implementation

Anticipated developments might see an increasing use of technology to track levy collection more accurately; shifting focuses based on sustainability targets; as well as broader international cooperation on levy standards particularly relating to carbon emissions and global commerce regulation.